So now as they smell blood Sunak and co are lining up their leadership challenges.

And -guess what- we hear from them, how they believe in low taxes. Like it is some fundamental article of faith.

Like they did pre the 2019 election...and then had to break that promise , though making sure it hit the low-paid more than the gilded classes. It wasn't breaking the promise that was deplorable, it was making the government a hostage to fortune 2 years earlier.

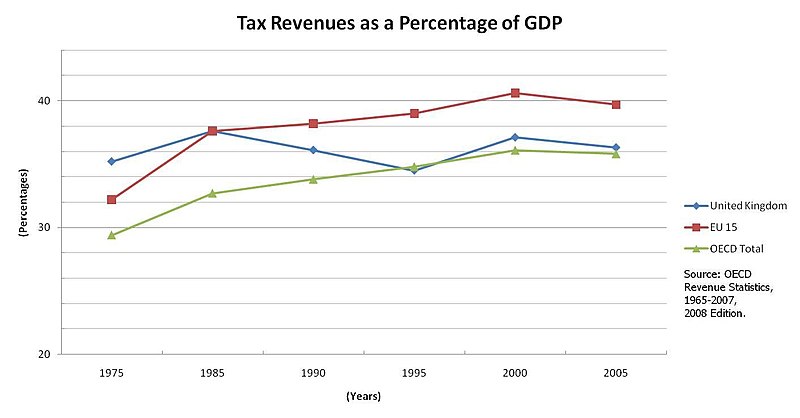

Why do they do this? Do they think higher taxes deter entrepreneurs? In 22 years of consulting work, with many smaller firm clients, I never once heard levels of taxation mentioned in any planning for the future. And if you look at European countries more prosperous than us- for example, the Scandis, Denmark, Germany, they all have higher taxation rates so that hasn't snuffed out business.

And at the personal tax level, I wonder in reality whether people fundamentally object. Most people I know would be happy to pay more if they knew it would be spent well- for example on healthcare, education and social care.

This is a seam Starmer should be mining.

|

|

||

|

Results 1 to 15 of 45

Thread: Low taxes

Check Todays Deals on Ebay.co.uk

Custom Search

|

Check Todays Deals On Amazon.co.uk Check Todays Deals on Ebay.co.uk

Be Seen - Advertise on Qlocal Corporate Sponsors

Southport Piano and Music Academy Washroom Services Maximum Grounds Maintenance Southport Garden Services Ormskirk Garden Services Sanitary Bins Nappy Bins & Waste Disposal Confidential Shredding Services Legionella Risk Testing London Washroom Services Croydon Washroom Services Hounslow Washroom Services Wandsworth Washroom Services Havering Washroom Services Sanitary Bins London Clinical Waste London General Waste London Legionella Testing London Shredding London Tatoo Waste London Preston Bird Control Blackpool Bird Control

UK, Local Online News Community, Forums, Chats, For Sale, Classified, Offers, Vouchers, Events, Motors Sale, Property For Sale Rent, Jobs, Hotels, Taxi, Restaurants, Pubs, Clubs, Pictures, Sports, Charities, Lost Found

UK,

UK News,

|

|

Stats: Qlocal over 500,000 page views a month (google analytics)

UK Masks,

UK Face Masks,

UK KN95 Masks,

UK Disposable Masks,

UK Hand Sanitiser,

UK Hand Sanitizer,

UK PPE,

UK Bathroom Supplies,

UK Cheap Bathrooms,

UK Discount Bathrooms,

UK Bathroom Sales,

UK Bathroom Suites,

UK Bathroom Taps,

UK Basin Taps,

UK Bath Taps,

UK Kitchen Taps,

UK Free Standing Bath Taps,

UK Bath Mixer Tap,

UK Bidet Taps,

UK Shower Enclosures,

UK Bi Fold Shower Doors,

UK Corner Showers,

UK Pivot Shower Doors,

UK Sliding Shower Doors,

UK Shower Side Panels,

UK Quadrant Showers,

UK Shower Trays,

UK Wet-Rooms,

UK Bathroom Showers,

UK Showers Valves,

UK Showers Rails,

UK Showers Heads,

UK Showers Arms,

UK Showers Handsets,

UK Showers Jets,

UK Showers Elbows,

UK Toilet Seats,

UK Toilets,

UK Basins,

UK Basin Wastes,

UK Combined Toilet Basin,

UK Bathroom Furniture,

UK Baths,

UK L Shaped Bath,

UK P Shaped Bath,

UK Bath Screens,

UK Sanitaryware,

UK Combined Toilet Basin,

UK Stoves,

UK Wood Stoves,

UK Home Stoves,

UK Cooker Stoves,

UK Enamel Stoves,

UK Designer Stoves,

UK Contemporary Stoves,

UK Multi Fuel Stoves,

UK Car Servicing,

UK MOTg,

UK Tyres,

UK Car Battery,

UK Exhaust,

UK Journalist Jobs,

UK Reporter Jobs,

UK Writing Jobs,

UK Freelance Writer,

UK Self Employed Jobs,

UK Franchise Business,

UK Franchise Opportunities,

UK Car Insurance,

UK Cheap Car Insurance,

UK Car Insurance Brokers,

UK Driving Schools,

UK Driving Lessons,

UK Driving Test,

UK Driving Theory Test,

UK Driving Instruction, 0000

UK Driving Instructor, 0000

UK Vouchers,

UK Deals,

UK Matalan,

UK Railway Sleepers,

UK Reclaimed Sleepers,

UK New Sleepers,

UK Coal,

UK House Coal,

UK Household Coal,

UK Smokeless Coal,

UK Smokeless Fuel,

UK Coal Bags,

UK Firewood,

UK Fire Wood,

UK Kiln Dried Hardwood,

UK Kiln Dried Logs,

UK Logs For Sale,

UK Log Supplies,

UK Logs,

UK Firewood Logs,

UK Seasoned Logs,

UK Hardwood Logs,

UK Firewood Suppliers,

UK Firewood Log Suppliers,

UK Firewood Dumpy Bags,

UK Firewood Crates,

UK Cheap Firewood,

UK Homefire Logs,

UK Cheap Firewood Logs,

UK Kindle Cones,

UK Pizza Oven Logs,

UK Heating Oil,

UK Home Heating Oil,

UK Red Diesel,

UK White Diesel,

UK Keresene,

UK Commercial Fuels,

UK Calor Gas,

UK Propane Gas,

UK Butane Gas,

UK Heating Gas,

UK Horse Training,

UK Horse Trainer,

UK Horse Whisperer,

UK Equine Whisperer,

UK Horse Whisperer Victoria Smith,

UK Rattan Garden Furniture,

UK Rattan Furniture,

UK Rattan Sofa,

UK Rattan Dining Set,

UK Rattan Direct,

UK Cheap Rattan Furniture,

UK Rattan Corner Sofas,

UK Rattan Day Beds,

UK Rattan Sun Loungers,

UK Rattan Cube Sets,

UK Rattan Bistro Sets,

UK Chimeneas,

UK Firepits,

UK Patio Heaters,

UK Hygiene Vending,

UK Washroom Vending,

UK Air Fresheners,

UK Air Care,

UK Aerosol Systems,

UK Gel Systems,

UK Water Saving,

UK Urinal Water Saving,

UK Eco Caps,

UK Sensaflush,

UK Water Management,

UK Urinal Dosing,

UK Urinal V Screens,

UK Legionella Risk Assessment,

UK Legionella Risk Testing,

UK Legionaires Risk Assessment,

UK Legionella Bacteria,

UK Legionaires Bacteria,

UK Legionella Compliance,

UK Legionella Advice,

UK Legionella Landlords Advice,

UK Legionella Testing,

UK Legionella Check,

UK Legionella Regulations,

UK Legionella Risk Assessment For Landlords,

UK Legionella Water Testing,

UK Legionella Quote,

UK Fire Stove Glass,

UK Heat Resistant Glass,

UK Fire Glass,

UK Stove Glass,

UK Fire Resistant Glass,

UK Replacement Stove Glass,

UK Glass For Stoves,

UK Dust Mats,

UK Entrance Mats,

UK Reception Mats,

UK Anti Fatigue Mats,

UK Floor Mats,

UK Logo Mats,

UK London Washroom Services,

UK London Sanitary Bins,

UK London Shredding Services,

UK London Trade Waste Disposal,

UK London Legionella Testing,

UK London Clinical Waste,

UK Washroom Services,

UK Principal Washrooms,

UK Washrooms Supplies,

UK Washrooms Solutions,

UK Sanitary Disposal,

UK Sanitary Bins,

UK Sani Bins,

UK Lady Bins,

UK Feminine Hygiene Units,

UK Sanitary Waste Disposal,

UK Sanitary Waste,

UK Sanitary Waste Bin,

UK Sanitary Waste Bins,

UK Sanitary Units,

UK Feminine Units,

UK Hygiene Services,

UK Sanitary Bin Supplier,

UK Sanitary Bin Rental,

UK Sanitary Bin Rental Services,

UK Sanitary Bin,

UK Sanitarybin,

UK Feminine Hygiene Bins,

UK Female Santary Bin,

UK Sani bin,

UK Sani bins,

UK Sanibin Rental,

UK Sanitary Box,

UK Sanitary Boxes,

UK Sanitary Bin Quote,

UK Sanitary Bin Price,

UK Sanitary Bin Cost,

UK Sanitary Disposal Quote,

UK Sanitary Disposal Price,

UK Sanitary Disposal Cost,

UK Free Duty of Care,

UK Tampon Bin,

UK Tampon Bins,

UK Sanitary Tampon Bin,

UK Sanitary Tampon Bins,

UK Sanitary Towel Bin,

UK Sanitary Towel Bins,

UK Feminine Waste,

UK Feminine Hygiene Waste,

UK Sanitary Waste Regulations,

UK Sanitary Waste Law,

UK Sanitary Bins Law,

UK Sanitary Bins For Small Business,

UK Sanitary Bin Service Cost,

UK Sanitary Bin Collection Cost,

UK Disposal of Sanitary Waste,

UK Sanitary Towel Bins,

UK Sanitary Towel Disposal,

UK General Waste,

UK Trade Waste,

UK Commercial Waste,

UK Business Waste,

UK Waste Management,

UK Waste Collection,

UK Cardboard Waste,

UK Paper Waste,

UK Plastic Waste,

UK Glass Waste,

UK General Waste,

UK Trade Waste,

UK Commercial Waste,

UK Business Waste,

UK Waste Management,

UK Waste Collection,

UK Cardboard Waste,

UK Paper Waste,

UK Plastic Waste,

UK Glass Waste,

UK Biomass Waste,

UK Metal Waste,

UK Paper Shredding,

UK Local Shredding,

UK Secure Shredding,

UK Confidential Shredding,

UK Document Destruction,

UK Confidential Waste,

UK Confidential Waste Service,

UK Confidential Waste Services,

UK Confidential Waste Shredding,

UK Confidential Waste Disposal,

UK Confidential Waste Destruction,

UK On Site Shredding,

UK Off Site Shredding,

UK One Off Shredding,

UK Contract Shredding,

UK GDPR Shredding,

UK

Shredding,

UK Document Shredding,

UK Shredding Services,

UK Mobile Shredding,

UK Dental Waste,

UK Dental Waste Disposal,

UK Dental Waste Legislation,

UK Dental Waste Compliance,

UK Accupuncture Waste,

UK Accupuncture Waste Disposal,

UK Accupuncture Waste Collection,

Accupuncture Waste in UK,

Accupuncture Waste Disposal in UK,

Accupuncture Waste Collection in UK,

UK Acupuncture Waste,

UK Acupuncture Waste Disposal,

UK Acupuncture Waste Collection,

UK Acupuncture Waste Service,

UK Acupuncture Clinical Waste,

UK Acupuncture Sharps,

UK Acupuncture Needles,

UK Beauty Salon Clincical Waste,

UK Beauty Salon Microblading,

UK Beauty Salon Needles,

UK Beauty Salon Sharps,

UK Tattoo Waste,

UK Tattoo Waste Disposal,

Tattoo Waste in UK,

Tattoo Waste Disposal in UK,

Tattoo Waste Collection in UK,

Tattoo Waste Compliance in UK,

Tattoo Waste Services in UK,

Tattoo Clinical Waste in UK,

Tattoo Sharps in UK,

Tattoo Needles in UK,

UK Sharps Bin,

UK Sharps Bins,

UK Sharps Collection,

UK Sharps Disposal,

UK Hazardous Sharps,

UK Non Hazardous Sharps,

UK Cytotoxic Sharps,

UK Cytostatic Sharps,

UK Ink Block,

UK Wet_Waste,

UK Tattoo Ink,

UK Drug Destruction,

UK Drug Disposal,

UK Drug Denaturing,

UK Unwanted Drugs,

UK Out Of Date Drugs,

UK Pest Control,

UK Rodent Control,

UK Bird Control,

UK Bird Proofing,

UK Guano Control,

UK Pest Call Out,

UK Pest Prevention,

UK Pest Deterrent,

UK Nursery Waste,

UK Nappy Waste,

UK Nappy Bin,

UK Nappy Bins,

UK Nappy Disposal,

UK Nappy Wheelie Bin,

UK Nursery Waste Disposal,

UK Nursery Waste Collection,

UK Nappy Waste Regulations,

UK Commercial Nappy Waste,

UK Nappy Disposal Bin,

UK Nappy Waste Collection,

UK Incontinence Pads,

UK Offensive Waste,

UK Human Waste,

UK Nursing Home Waste,

UK Care Home Waste,

UK Hazardous Waste,

UK Infectous Waste,

UK Pharmaceutical Waste,

UK Medicinal Waste,

UK Medicine Waste,

UK Infection Control,

UK Hand Sanitisers,

UK Clinical Waste,

UK Clinical Waste Removal,

UK Clinical Waste Collection,

UK Clinical Waste Regulations,

UK Clinical Waste Disposal,

UK Clinical Waste Management,

UK Clinical Waste Policy,

UK EA Registration,

Sell my scrap van in UK,

Washroom Services in Tarleton,

Sanitary bins quote,

Garden Services in Southport,

Garden Services in Ormskirk,

Garden Services in Formyb,

Garden Services in Tarleton,

UK Path Gravel,

UK Path Gravels,

UK Gravel,

UK Gravels,

UK Garden Path Gravel,

UK Decorative Gravels,

UK Cotswold Gravel,

UK Bulk Aggregates,

UK Mass Aggregates,

UK Aggregates Suppliers,

UK Aggregate Suppliers,

UK Bulk Bags Aggregates,

UK Bulk Bags,

UK Mot Type 1,

UK Mot Type 2,

UK Top Soil,

UK Building Sand,

UK Grit Sand,

UK Fine Sand,

UK Play Sand,

UK Top Dressing Sand,

UK Silica Sand,

UK Mersey Sand,

UK Kiln Dried Sand,

UK Plastering Sand,

UK Crusher Run,

UK Dust,

UK Ballest,

UK Hardcore,

UK Grit,

UK Horticultural Grit,

UK Alpine Grit,

UK Limestone,

UK Granite,

UK Cotswold Chippings,

UK Golden Flint,

UK Moonstone,

UK Pea Gravel,

UK Cheshire Pink,

UK Yorkshire Cream,

UK Derbyshire Peak Stone,

UK Green Ballast,

UK Autumn Gold,

UK Pink Gravel,

UK Blue Slate,

UK Plum Slate,

UK Grey Slate,

UK Welsh Slate,

UK Play Bark,

UK Chip Bark,

UK Christmas Trees,

UK Xmas Trees,

UK Artificial Tree,

UK Christmas Decorations,

Reply With Quote

Reply With Quote